Introduction

The export is designed to export the revenue and payments registered in Clock, saving a lot of time and effort. The file structure is standardized and follows SKR 03/4 chart of accounts established by Datev.

Preparations

- Make sure your financial system also supports SKR 03/4 chart of accounts and is configured to use them.

- Activate Datev from the AppConnector in Clock - menu Settings -> AppConnector. Locate Datev and click 'Activate'.

- At the bottom of this article you will find example export files.

How does the interface work

Once activated, in the integration card in the AppConnector, a "Settings" button will appear. From there, you can generate the export from the "Export" tab. Enter the period for which you want to receive the export file. The file will be emailed to your set delivery email address (see below).

If you have a Clock POS account, for which you want to generate Datev exports, you can follow the same activation steps and activate the integration from the AppConenctor in your POS account.

Exported data

The following Clock operations will be exported in the Datev export file:

- Operations related to revenue. Here you can find out how the revenue system in Clock PMS+ works. The export follows the principle of day-by-day revenue recognition. For example: nights from 1st January are recognized as revenue for 1st January. In other words, every charge will be accounted for the revenue date it affects.

- Operations related to advanced payments. Here you can find more information about deposits, advanced payments, the difference between the two, and how to operate with them. The advanced payments in Clock PMS+ may be handled differently from an operational perspective. However, they are all accounted identically, and the information about the change of the advanced payments will be exported for the affected revenue date by the Datev export.

Note: If you decide to use the deposit option (instead of advanced payments) in ClockPMS+, the export will treat it just as a registered payment without affecting the advanced payments accounts;

- Operations related to payments. Here you can find more information about the payments and the related operations. The payments are accounted for the revenue date when they were registered and hence will be exported for that date. All modifications are considered as separate payment events and will be exported as such for the affected revenue date.

Examples

- A booking for the future is created, and an advance payment is collected. When the booking is created for the future, the charges are generated immediately for the respective dates. However, they are considered as future revenue and hence are not included in the export file on the date when the booking is created. If an advanced payment is registered, it will be accounted for the day of receiving it together with the payment. Example export is available as attachment - (Datev-export(14.08.2024)Advanced_payment_collected.csv);

- Booking was checked-in, and additional services were charged to the booking folios. Following the day-by-day revenue recognition principle, the revenue for every night of the guests' stay will be accounted for the respective date, together with all extra services the guest consumed on the given date. Example export is available as attachment - (Datev-export(01.09.2024)Check-in_and_extra_services.csv);

- A correction of charges for the past occurred. For instance, the customer was given a discount for all services they had. The export will contain the revenue for the day and the discounts affecting the given revenue date. In the case discount for the current date as well as for the previous day. Since the discount results in a negative charge in Clock PMS+ the information would be exported as credit one (Soll/Haben-Kennzeichen will contain 'H'). Example export is available as attachment - (Datev-export(02.09.2024)Daily_revenu_and_discount_provided.csv);

- The advanced payment was used, and the remaining amount was paid. At the check-out date the advanced payment is used and is exported together with the generated revenue for the day (including the discount) and the payment of the outstanding balance of the customer. Example export is available as attachment - (Datev-export(03.09.2024)Check-out_date .csv).

Configuration

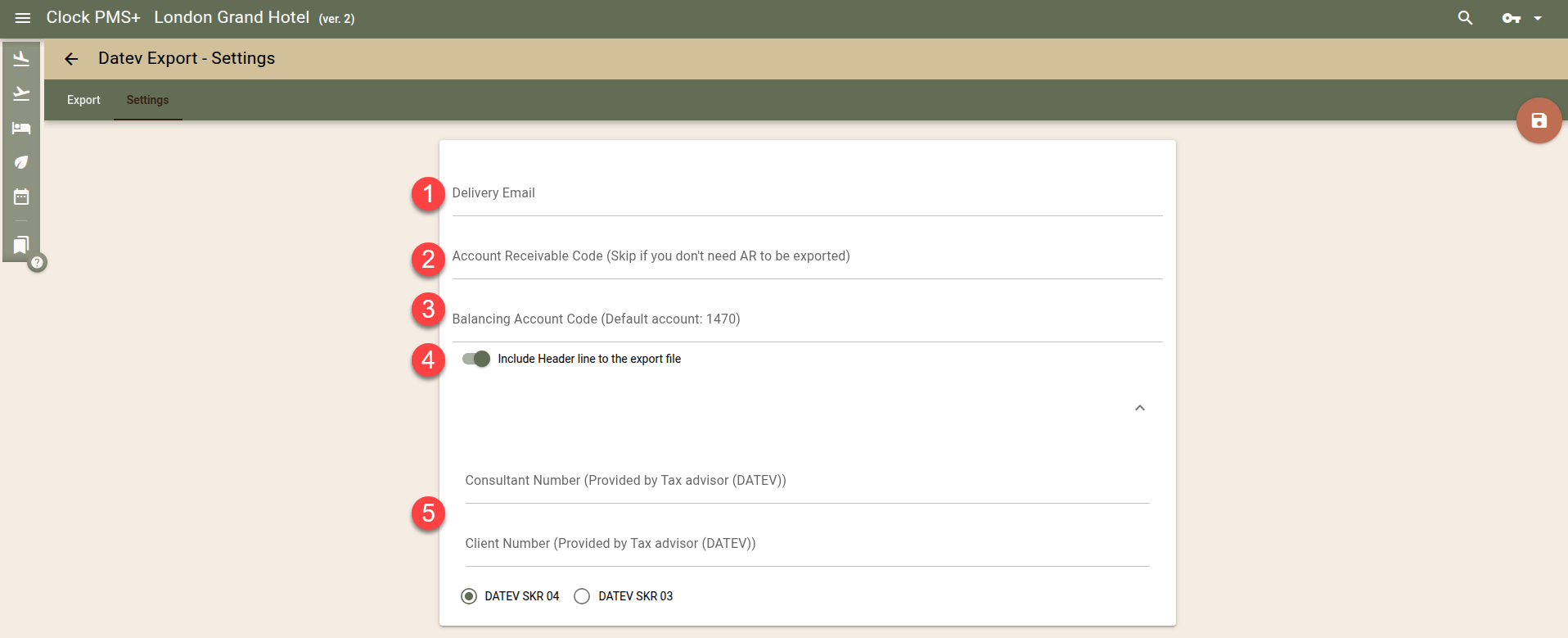

- Delivery email (1) - set the email address on which you will receive the export file

- Accounts Receivable (AR) code (2) - If such a code is configured, all customer invoice data will be posted collectively to a single AR control account in DATEV, where you can set up individual sub-accounts per customer if needed. If your accountant prefers to handle receivables directly in DATEV, you can leave this field empty.

- Balancing account code (3) - each accounting entry is posted by default against a fixed account (1470) on the Debit / Credit side. You can configure the account used according to your accounting policy requirements.

- Include Header line in the export file (4) - Adding a header facilitates easier import of the file into your financial system. For correct completion of the data in it, you need to configure the following information, which you can obtain from your accountant / tax advisor:

- Consultant number / Client number / Type of Chart of accounts (5)

Configuring the Revenue accounting code field

The account codes in Clock PMS+ are defined as a new field for the charge templates.

- Navigate to menu Settings -> All Settings -> Charge custom Fields > and check if a field with a name datev_account already exists. If not, please create one with Name: datev_account and Type: string

Once the datev_account field is created, you can start defining the account codes for the list of charge templates.

- Navigate to menu Settings -> All Settings -> Charge Templates and Edit each charge template and fill in the respective account code in Datev account field.

Note: Keep in mind the datev_account field needs to be filled in before posting charges to booking/folios. However, if you already have charges created, you can still update their Datev account values using the Charge Custom Field Check Report.

Configuring Cost center field (OPTIONAL - create the field if your accounting needs it)

The account codes in Clock PMS+ are defined as a new field for the charge templates.

- Navigate to menu Settings -> All Settings -> Charge custom Fields > and check if a field with a name cost_center already exists. If not, please create one with Name: cost_center and Type: string

Once the cost_center field is created, you can start defining the cost centers for the list of charge templates.

- Navigate to menu Settings -> All Settings -> Charge Templates and Edit each charge template and fill in the respective account code in Cost center field.

Note: Keep in mind the cost_center field needs to be filled in before posting charges to booking/folios. However, if you already have charges created, you can still update their Cost center values using the Charge Custom Field Check Report.

Payment accounting code configuration

- Navigate to menu Settings -> All Settings -> General ledger accounts, review the existing configurations, and create new ones specifying the attributes in the screen.

Note: The first match the system finds will assign the payment code. For example, if a code 123 is configured for Payment type = Bank and code 456 is configured for the combination Payment type = Bank and Payment subtype = National Bank, the system will find the first match, and the code will be 123. However, you can use the Sort order (ascending) to configure how the code configuration would apply, and if the code 123 has Sort order = 2 and 456 with Sort Order = 1, the latter will match first, and 123 will be the default one for the bank payments.

Unlike the Revenue accounting code, the change ot the General ledger account code will immediately affect the General ledger account of the payments.

Specifics and limitations

- Accounting codes default values. Please note that the default values may be changed upon your request:

- If the General ledger account (payment accounting code) or datev_account code (Revenue accounting code) is not present, then the export will use the default one - 1470.

- Advanced payments - 3276

- Tax round difference - 1470

- The amounts in the export file are always positive. However, to ensure proper accounting on the records, the column Soll/Haben-Kennzeichen will contain 'H' for negative revenue/payment/advanced payment and 'S' for a positive one;

- The data is exported with the amount and currency as it was registered;

- Field Belegfeld 1 contains the unique ID of the folio the charges/payments are posted to. In case an Invoice was issued, its number will be exported there, separated by ' / ' from the folio ID. Example: "123456 / INV392" and the invoice is issued, and "123456" if not;

- Field Buchungstext contains the name of the charge for charge rows and the name of the payer for payment rows;

- The charge / payment cancellation will be treated as a credit transaction, and hence Soll/Haben-Kennzeichen will contain 'H';

- Field KOST1 - Kostenstelle of the export file will contain the values configured for Cost center(if configured).